When a drug hits the market, the clock starts ticking. Twenty years after its original patent is filed, any company can make a copy - a generic version - and sell it for a fraction of the price. But what if that clock could be reset? That’s the reality of evergreening, a strategy used by big pharmaceutical companies to keep generics off the market long after the original patent should have expired.

What Evergreening Really Is

Evergreening isn’t about inventing new medicines. It’s about tweaking old ones just enough to file a new patent. Think of it like changing the color of a car model every year and calling it a ‘new release’ - even though the engine, chassis, and performance haven’t changed. In pharma, this means altering the dosage form, switching from a tablet to a capsule, combining two existing drugs, or changing how the drug is released in the body. These aren’t breakthroughs. They’re minor tweaks.

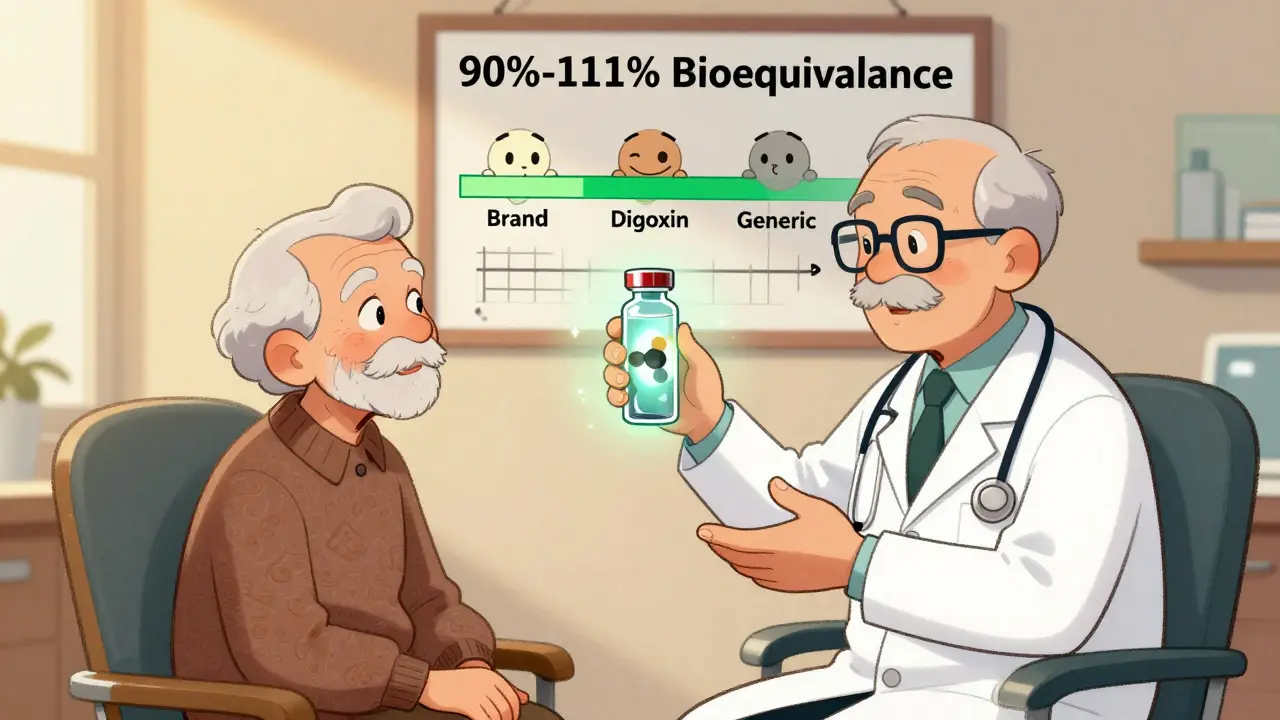

The goal? Extend monopoly control. Once a drug’s original patent expires, generics can enter and prices drop by 80-85% within a year. But if a company gets a new patent on a ‘modified’ version, it blocks generics from entering - even if the new version offers no real benefit to patients. The FDA still approves it because the law doesn’t require proof of improved effectiveness, only that it’s safe and bioequivalent.

The Tools of the Trade

Pharmaceutical companies don’t wing this. They have teams dedicated to lifecycle management - people who start planning 5 to 7 years before the patent runs out. Their job? Find loopholes in patent law and regulatory rules. Here’s how they do it:

- Product hopping: The company stops selling the original drug and pushes patients to a new version - often with a slightly different delivery system. AstraZeneca did this with Prilosec (omeprazole) and Nexium (esomeprazole). Nexium wasn’t better - it was just the single-isomer version of the same molecule. But because it had a new patent, generics couldn’t enter for years.

- Patent thickets: Instead of one patent, companies file dozens. AbbVie filed 247 patents on Humira, a drug for autoimmune diseases. Over 100 were granted. Generic makers can’t afford to fight all of them in court. Even if one patent is invalidated, another holds the line.

- Orphan drug status: If a drug is repurposed for a rare disease, it gets 7 years of exclusivity, even if it’s been on the market for decades treating common conditions.

- Pediatric exclusivity: Companies run small studies in children - sometimes just to get an extra 6 months of protection. No new benefit to kids is needed.

- Authorized generics: The brand company itself launches a generic version at a lower price - but only after blocking other generics. This keeps control of the market while appearing to support affordability.

These aren’t edge cases. They’re standard practice. A Harvard study found that 78% of new patents on prescription drugs were for existing drugs, not new ones. That means most patent activity isn’t innovation - it’s legal gymnastics.

The Cost to Patients and Systems

Every year a drug stays off generics, patients pay more. Humira, for example, cost $70,000 per year in the U.S. before generics arrived. It generated $40 million in daily revenue for AbbVie. That’s not just corporate profit - it’s money taken from insurance plans, Medicare, and out-of-pocket budgets of people with rheumatoid arthritis, Crohn’s disease, and psoriasis.

Generics aren’t ‘cheap imitations.’ They’re identical in active ingredient, strength, and safety. The only difference? Price. A 2022 study showed that when generics entered the market for a top-selling cholesterol drug, U.S. spending dropped by $1.2 billion in just 12 months. That’s billions saved - if generics are allowed in.

But evergreening delays that. In Australia, where drug pricing is tightly regulated, patients still feel the pinch. A 2023 report from the Pharmaceutical Benefits Scheme showed that 14 of the top 20 most expensive drugs on the list had patent extensions. Patients waited years longer than they should have for affordable versions.

Why It’s Legal - And Why It Shouldn’t Be

The system was designed to balance innovation and access. The 1984 Hatch-Waxman Act in the U.S. created a path for generics to enter quickly after patent expiry - but it didn’t close the door on patent manipulation. The law allows companies to file new patents if they can show ‘new clinical data’ - even if that data only proves the drug works the same way, just in a different form.

Regulators like the FDA and USPTO are aware. The USPTO has started rejecting obvious patent claims, and the FDA has tried to speed up generic approvals. But enforcement is patchy. A patent application can sit for years before being reviewed. By then, the brand company has already built its market.

Europe has taken a harder line. The European Medicines Agency now requires proof of ‘significant clinical benefit’ before granting extra exclusivity. That’s why you don’t see as many product hops there. In the U.S., you just need to prove the drug isn’t dangerous.

Pushback Is Growing

Legal challenges are mounting. In 2022, the U.S. Federal Trade Commission sued AbbVie over Humira’s patent thicket, calling it an illegal monopoly. The case is still ongoing, but it’s a sign that regulators are finally paying attention.

The Inflation Reduction Act of 2022 gave Medicare the power to negotiate prices for 10 high-cost drugs - and more will be added each year. That directly attacks the financial incentive for evergreening. If the government can cap prices, why spend $100 million on 247 patents?

Global health organizations are speaking up too. The World Health Organization labeled evergreening a barrier to medicine access in low- and middle-income countries. In places like India and Brazil, where generics are the lifeline for millions, patent extensions mean people go without treatment.

What’s Next?

Companies aren’t backing down. They’re moving to more complex targets: biologics, gene therapies, nanotech formulations. These are harder to copy, so even if patents expire, generics can’t easily follow. But that’s not innovation - it’s a new kind of lock.

The real solution? Change the rules. Require proof of meaningful clinical improvement before granting new exclusivity. Limit patent extensions to one per drug. Ban product hopping. End authorized generics as a tactic. Make patent review faster and stricter.

Until then, patients will keep paying more - not because drugs are better, but because the system lets companies rewrite the rules to protect profits over access.

How You Can Spot It

If your prescription suddenly switches from a generic to a brand-name version - and the pill looks different, or you’re told the old one is ‘no longer available’ - that’s a red flag. Ask your pharmacist: ‘Is this a new patent version?’ If they hesitate, dig deeper. Check the drug’s patent status on the U.S. FDA’s Orange Book or your country’s equivalent. You’re not just a patient - you’re a consumer. And you have a right to know why your medicine costs what it does.

Is evergreening the same as patent infringement?

No. Evergreening is legal under current U.S. and many international patent laws. Companies don’t break the law - they use its loopholes. They file patents for minor changes that technically meet the legal definition of ‘novelty’ or ‘non-obviousness,’ even if the changes are clinically meaningless. It’s exploitation of the system, not illegal activity.

Do evergreened drugs work better than generics?

Almost never. Studies consistently show that modified versions - like Nexium vs. Prilosec or extended-release versions of old drugs - have no measurable improvement in patient outcomes. In many cases, they’re identical in active ingredient. The only difference is price. Patients are often switched to the new version not because it’s better, but because the original is no longer sold.

Can I ask my doctor to prescribe the generic instead?

Yes - and you should. Ask if the brand-name drug you’re being prescribed has a generic version available. If your doctor says it doesn’t, ask if the drug has been recently reformulated. If it has, check the patent status. In many cases, the original drug is still available under a different brand or as a generic, and the new version is just a marketing tactic. Your doctor may not know about the patent strategy - but you can bring it up.

Why don’t generic companies fight these patents more often?

Because it’s too expensive and risky. Challenging a single patent can cost $5 million to $10 million in legal fees. When a company files 20, 50, or 200 patents - like AbbVie did with Humira - the cost becomes impossible. Generic makers often wait until the last patent expires, even if it means waiting years longer than they should. That’s exactly what the brand companies count on.

Are there countries where evergreening is banned?

Not outright banned, but strictly limited. India, for example, doesn’t allow patents on minor modifications of existing drugs under Section 3(d) of its patent law. The European Union requires proof of ‘significant therapeutic advantage’ for new exclusivity. Canada and Australia have also tightened rules. But in the U.S., the system still favors brand companies - and that’s where most global drug pricing is set.

How does evergreening affect drug prices globally?

It keeps prices high everywhere. Even if a drug is cheap in India or Brazil, the global market price is often set by what’s charged in the U.S. Because big pharma makes most of its profits from the U.S. market, they price drugs high there - and other countries end up paying similar rates. When generics are blocked in the U.S., it delays price drops worldwide. That’s why patients in low-income countries still pay 10x more than they should for life-saving drugs.

Matt W

They’re not even trying to hide it anymore. Just slap a new coating on an old pill and call it a day. Patients are getting screwed while execs cash in. It’s disgusting.

Anthony Massirman

Same old story. Pharma doesn’t cure, it monetizes.

George Firican

The entire system is built on a fiction-that innovation equals patent extensions. But innovation isn’t rebranding a molecule with a new release profile. It’s discovering something that didn’t exist before. We’ve turned medicine into a corporate game of musical chairs, where the chairs are patents and the music is shareholder earnings. When the music stops, patients are left standing with no seat, no discount, and no recourse. The FDA’s hands are tied by laws written in the 1980s, before anyone imagined that a single drug could spawn nearly 250 patents. That’s not a loophole-it’s a backdoor into a monopoly. And it’s not just Americans suffering. The global pricing model is anchored to U.S. costs, so when Humira stays at $70K here, it stays unaffordable everywhere else. India’s Section 3(d) is the only sane policy on the books-no patent for trivial changes. Why can’t we adopt that? Because lobbying money speaks louder than patient suffering. We’re not just paying for drugs-we’re paying for legal teams, marketing campaigns, and executive bonuses disguised as R&D.

Solomon Ahonsi

Of course it’s legal. The law was written by the same people who own the companies doing this. Wake up. This isn’t capitalism-it’s feudalism with a pharmacy label.

Akhona Myeki

Let me be clear: this is not a problem of regulation. This is a problem of moral bankruptcy. In South Africa, we watch as children go without essential medicines because the same patents that block generics here are enforced globally. The U.S. does not lead in innovation-it leads in exploitation. This is economic colonialism dressed in white coats.

Chinmoy Kumar

so like in india we have generic drugs that cost like 10% of the us price and its the same chemcial right? why cant the us just import them? i mean its not like theyre fake or anything… just cheaper… i dont get it

Sandeep Kumar

patent thickets are just corporate bullying with a law degree

Gary Mitts

So what you're saying is… the FDA approves drugs that don't do anything better? And we pay for it? Wow. Just wow.

Bridget Molokomme

They call it "product hopping" like it's a fashion trend. "Ooh, this omeprazole is so last season, now try esomeprazole!"

clarissa sulio

My dad’s on Humira. He’s been on it for 8 years. Last year they told him the old version was discontinued. He didn’t even know the new one was the same damn drug. They just switched him without telling him why. That’s not care. That’s manipulation.