Formulary Tiers Explained: How Your Insurance Picks Which Drugs Cost Less

When you pick up a prescription, the price you pay isn’t just about the drug—it’s shaped by something called a formulary tier, a system used by insurance plans to group medications by cost and clinical value. Also known as a drug formulary, it’s how your pharmacy benefit manager decides which drugs are affordable and which aren’t. You might not see it on your receipt, but formulary tiers are the hidden rules that decide if your pill costs $5, $45, or $300.

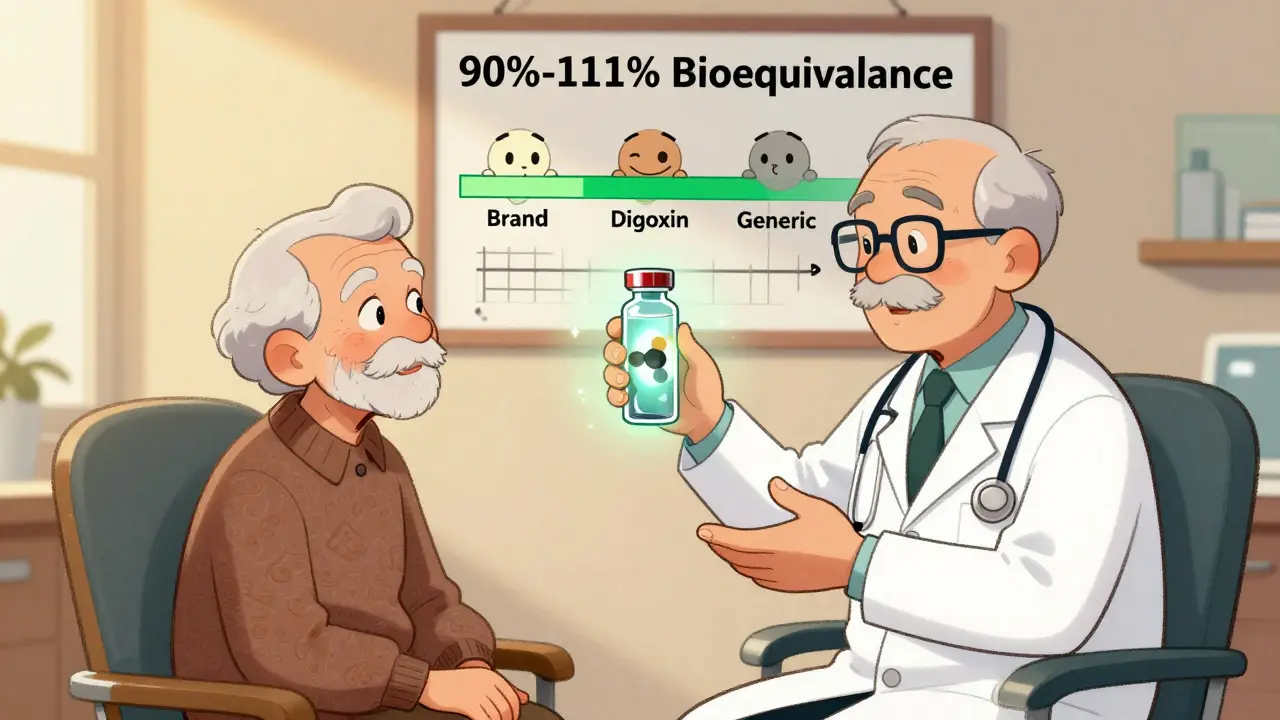

Most plans use 3 to 6 tiers. Tier 1 is usually generic drugs—cheap, effective, and preferred. Tier 2 is brand-name drugs with generic alternatives. Tier 3 is brand-name drugs without generics, often more expensive. Tier 4? That’s specialty drugs: injectables, cancer meds, or treatments for rare conditions. Some plans even have Tier 5 or 6 for the most costly therapies. Your plan doesn’t pick these tiers randomly. They’re based on cost, safety data, and whether the drug is considered medically necessary. If your doctor prescribes a drug on Tier 4, your insurer might require you to try a cheaper Tier 1 or 2 drug first. That’s called step therapy, and it’s built right into the formulary structure.

It’s not just about price—it’s about access. A drug might be FDA-approved, but if it’s not on your plan’s formulary, you could pay full price. Some plans even put the same drug on different tiers depending on the condition it’s used for. For example, metformin might be Tier 1 for diabetes but Tier 3 if prescribed for weight loss. This is why knowing your formulary matters. It’s not just a list—it’s a filter. Your doctor might not know which tier your drug is on unless you ask. And if you’re on multiple meds, the tier system can make or break your budget. You can usually find your plan’s formulary online, often under "Drug List" or "Formulary Search." Look for the tier next to each drug name. If yours is on a high tier, ask your pharmacist or doctor: Is there a lower-tier alternative? Can we appeal the tier placement? Some insurers will change the tier if you prove the cheaper option doesn’t work.

Formulary tiers aren’t the same everywhere. Medicare Part D plans, Medicaid, and private insurers all have their own. A drug on Tier 2 with one plan might be Tier 4 with another. That’s why switching plans mid-year can surprise you with a sudden price jump. And while generic drugs are usually cheaper, not all generics are treated equally—some plans still push higher-tier brands, even when generics exist. The pharmacy benefit manager, a company hired by insurers to manage drug benefits and negotiate prices is the real power behind the scenes. They strike deals with drug makers, and those deals shape your tier. If a drug maker pays a bigger rebate, the insurer puts it on a lower tier—even if it’s not better than a cheaper alternative.

What you’ll find in the posts below are real stories and breakdowns about how these systems affect you. You’ll see how certain medications like cyclosporine or lifitegrast fit into formulary tiers, why some patients pay hundreds for pills that should be cheap, and how to challenge a tier decision. You’ll learn why a drug like Combipres might be on a higher tier than expected, how NTI drugs like warfarin get special handling, and why generic drugs still face resistance even when they’re just as safe. These aren’t abstract rules—they’re daily financial and health decisions. And you have more power over them than you think.

Medicare Part D Formularies: How Generic Coverage Works in 2025

Learn how Medicare Part D formularies cover generic drugs in 2025, including tiered pricing, the $2,000 out-of-pocket cap, and how to save hundreds on prescriptions. Updated for current rules.