When you’re on Medicare and take regular medications, your prescription costs don’t just depend on the drug name-they depend on your plan’s formulary. And if you’re taking generics, which most Medicare beneficiaries do, understanding how those are covered can save you hundreds-or even thousands-of dollars a year. As of 2025, nearly 92% of all prescriptions filled under Medicare Part D are generics. That’s not an accident. It’s by design. The system rewards lower-cost drugs, and if you know how to use it, you can cut your out-of-pocket spending dramatically.

What Is a Medicare Part D Formulary?

A formulary is just a list of drugs your plan covers. Every Medicare Part D plan has one, and it’s not the same across plans. Some cover more generics than others. Some put the same generic in a lower cost tier. And since 2025, the rules around how much you pay have changed in big ways.These lists aren’t random. They’re built by Pharmacy and Therapeutics (P&T) committees-groups of doctors and pharmacists who review clinical data and cost. Every plan must cover at least two different generic versions of each drug class, and they must cover at least 85% of all drugs in each category. For six protected classes-like antidepressants, antiretrovirals, and anticonvulsants-they must cover every generic available. That’s because these drugs aren’t optional; they’re life-saving.

How Generics Are Tiers in Part D

Medicare Part D plans use a five-tier system to organize drugs by cost. Generics live mostly on the bottom two tiers:- Tier 1: Preferred Generics - These are the cheapest options. Most plans charge $0 to $15 for a 30-day supply. If you’re on blood pressure meds, cholesterol pills, or diabetes drugs, this is where you want to be.

- Tier 2: Non-Preferred Generics - Still generic, but not the plan’s top pick. You might pay $15 to $40, or 25-35% coinsurance. Sometimes, your plan covers one generic for a drug but not another-even if they’re chemically identical.

- Tiers 3-5: Brand-name and specialty drugs - These cost more. Generics rarely appear here unless they’re new or high-cost (like some cancer drugs).

Why does this matter? Because your tier determines what you pay each month. A Tier 1 generic might cost you $5. A Tier 2 version of the same drug could cost $35. That’s $360 a year difference-just for one medication.

How Much You Pay in 2025 (The New Rules)

The Inflation Reduction Act changed everything in 2025. Before, you hit a coverage gap-called the “donut hole”-where you paid a lot out of pocket. Now, there’s a hard cap: $2,000 per year on what you pay for all your drugs, including generics.Here’s how it breaks down:

- Deductible - You pay the first $615 of drug costs in 2025 (up from $590 in 2024). Some plans have $0 deductible-check yours.

- Initial Coverage Phase - After the deductible, you pay 25% of the cost for generics. Your plan pays the other 75%. This continues until your total out-of-pocket spending hits $2,000.

- Catastrophic Coverage - Once you hit $2,000, you pay $0 for the rest of the year. No more coinsurance. No more surprises. This applies to all drugs-generics and brands alike.

Here’s the twist: For brand-name drugs, 70% of the cost (including manufacturer discounts) counts toward your $2,000 cap. But for generics, only what you actually pay counts. That means if you’re on mostly generics, you’ll hit the cap faster-and save more.

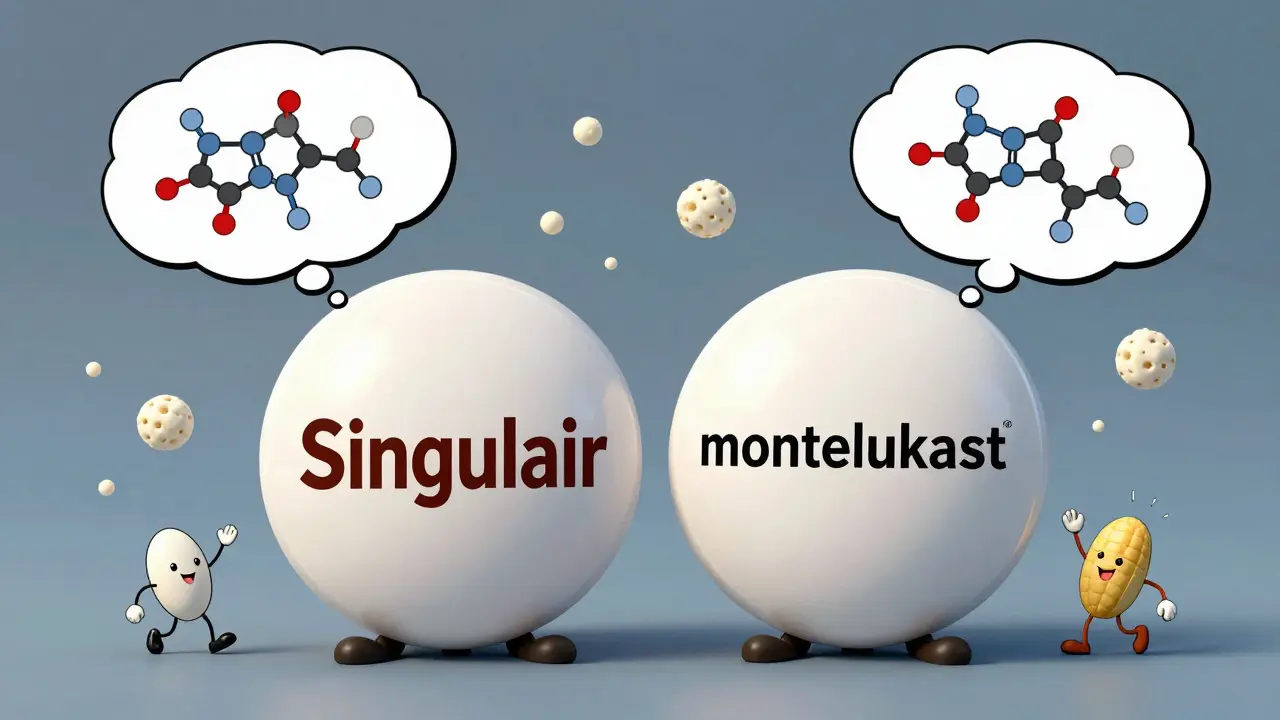

Why Generics Are So Cheap (And Why That Matters)

Generics are chemically identical to brand-name drugs but cost way less because they don’t need to repeat expensive clinical trials. In 2024, generics made up 92% of Part D prescriptions but only 18% of total drug spending. That’s the power of competition.For example, a brand-name statin like Lipitor might cost $150 a month. Its generic, atorvastatin, costs $10. That’s not a typo. That’s $1,680 a year saved. Multiply that by three or four medications, and you’re talking about $5,000+ in annual savings.

But here’s the catch: Not all generics are treated equally. Some plans favor one generic over another-even if they’re the same drug. You might be prescribed atorvastatin, but your plan only covers rosuvastatin. If you switch, you could pay full price. That’s why checking your formulary before enrolling is critical.

What to Do When Your Generic Isn’t Covered

You get a new prescription. You go to the pharmacy. They say, “We don’t cover this generic.” What now?First, ask if there’s another generic in the same class your plan covers. Sometimes, your pharmacist can swap it out. But if they can’t-or if you’re allergic to the alternative-you can request a coverage determination. That’s a formal appeal to your plan asking them to cover the drug.

According to CMS data, 83% of these requests are approved-especially if your doctor writes a letter explaining why the specific generic is necessary. Don’t assume your plan will deny it. Fight for it.

Also, check your plan’s Annual Notice of Change (ANOC). Every fall, plans send this letter. It tells you what’s changing in 2025-like which generics moved tiers or got dropped. If your drug was on Tier 1 last year and is now Tier 3, you might want to switch plans during Open Enrollment.

How to Pick the Best Plan for Your Generics

You can’t just pick the cheapest monthly premium. You have to look at your actual meds.Use the Medicare Plan Finder tool. Enter your exact drug names-including the generic version you take-and it will show you:

- Which tier each drug is on

- Your estimated annual cost

- Whether the plan has a $0 deductible

- If your pharmacy is in-network

KFF found that people who use this tool save an average of $427 a year. That’s not small change. If you take three or four generics, you could save over $1,000.

Also, look for plans with $0 copays on Tier 1 generics. In 2025, over half of stand-alone Part D plans offer this. If you’re on a fixed income, this is your best bet.

Real Stories: What People Are Saying

One user on Reddit, “MedicareVeteran82,” said his plan covered one generic blood pressure drug but not another-even though both were FDA-approved. He ended up paying $120 a month out of pocket until he switched plans. Another, “SmartSenior2024,” said her three generic heart meds now cost $0 thanks to her plan’s Tier 1 coverage. She saves over $300 a month.CMS’s 2024 survey showed that 87% of people on mostly generics were satisfied with their drug coverage-compared to 76% of those on brand names. Why? Because generics are predictable. Once you hit the $2,000 cap, you pay nothing. No more guessing.

The Future: What’s Coming Next

By 2026, all Part D plans must include a “generic price comparison tool” in their member portals. That means you’ll be able to see, right on your phone, which generic version of your drug costs the least.In 2029, the government will start negotiating prices for certain generics-starting with insulin glargine. That’s the first time Medicare will directly control generic drug prices. It’s a big shift.

And the trend is clear: More generics, lower prices, better access. The Congressional Budget Office predicts 94% of Part D prescriptions will be generic by 2030. That’s good news for everyone.

Quick Checklist: What You Should Do Now

- Make a list of every medication you take-brand and generic.

- Go to Medicare.gov/plan-compare and enter your drugs.

- Check if your current plan covers your exact generic version.

- Look for plans with $0 deductible and $0 Tier 1 copays.

- Review your Annual Notice of Change before December 7, 2025.

- If a drug you need isn’t covered, file a coverage determination request.

You don’t need to be an expert to save money. You just need to know where to look-and what to ask for.

Tejas Bubane

Let me get this straight - we’re celebrating a $2000 cap like it’s some revolutionary breakthrough? In any other country, this would be baseline. We’re still paying more for insulin than people in Canada, and now we’re patting ourselves on the back for capping out-of-pocket costs at two grand? Pathetic.

Ajit Kumar Singh

Generics are the only reason I’m still alive honestly my BP med used to cost me 180 a month now its 5 and I dont even have to think about it anymore

Angela R. Cartes

It’s fascinating how the system rewards cost-efficiency while completely ignoring patient autonomy. The P&T committees are essentially rationing care under the guise of fiscal responsibility. And don’t get me started on how they favor one generic over another - it’s not pharmacology, it’s corporate arbitrage disguised as clinical judgment.

And yes, I know the math. I’ve done the spreadsheets. But this isn’t about savings - it’s about control. Who gets to decide what ‘equivalent’ means? Not you. Not your doctor. Some bureaucrat in a Blue Cross backroom.

And yet, we’re supposed to be grateful for the $0 Tier 1 copays? Please. That’s the carrot. The stick is still the 30% coinsurance on your antidepressants when they move you to Tier 2 because the manufacturer didn’t kick back enough.

Lisa Whitesel

People think generics are the same but they’re not. My doctor prescribed me the exact same generic twice and one made me dizzy the other didn’t. The FDA doesn’t care. Neither does your plan. You’re just a number.

Larry Lieberman

So if I’m on 4 generics and hit the $2000 cap by August… I pay $0 for the rest of the year? 😱 That’s wild. I’m going to check my plan right now. Also - anyone know if metformin is still Tier 1 in 2025? Asking for a friend who’s basically a diabetic vending machine.

Sabrina Thurn

The structural incentives here are actually quite elegant - aligning formulary design with clinical necessity and cost-effectiveness. The 85% coverage mandate across therapeutic classes ensures therapeutic adequacy, while the protected classes (antiretrovirals, anticonvulsants, etc.) prevent catastrophic therapeutic exclusion. The shift from manufacturer rebates to direct patient cost containment via the $2,000 out-of-pocket cap is a monumental recalibration - particularly because generics now count only as out-of-pocket spend, accelerating catastrophic coverage attainment for polypharmacy patients. This isn’t just policy; it’s actuarial justice.

That said, the lack of standardization across formularies remains a systemic flaw. Two plans covering the same generic at different tiers based on negotiated rebates - not clinical equivalence - creates perverse incentives for patients to chase formularies instead of health outcomes. The upcoming 2026 price comparison tool is a necessary corrective, but it should’ve been mandated in 2020.

Courtney Black

It’s interesting how we’ve turned medicine into a spreadsheet. We don’t talk about healing anymore. We talk about tiers and copays and caps. We’ve forgotten that a person isn’t a drug utilization review. That atorvastatin isn’t just a line item - it’s the thing that keeps your uncle from having a stroke. And yet we celebrate the $5 generic like it’s a gift from the gods, when really it’s just the bare minimum we should’ve been giving people since 2005. We’ve normalized survival. And that’s the saddest part.

iswarya bala

OMG I just checked my plan and my cholestrol med is now $0!! I was so scared I was gonna have to choose between meds and groceries but now I can breathe again 😭 thank you for this post!!

Simran Chettiar

One cannot help but reflect upon the ontological implications of pharmaceutical policy as it pertains to the lived experience of geriatric populations in a neoliberal healthcare apparatus. The formulary, as a technocratic instrument of governance, reduces the patient to a statistical variable within a cost-benefit matrix, wherein therapeutic efficacy is subordinated to actuarial logic. The $2,000 cap, while ostensibly benevolent, functions as a palliative measure - a bureaucratic salve applied to a systemic wound that continues to hemorrhage in the form of pharmaceutical monopolies, patent evergreening, and the commodification of biological necessity. The fact that generics, chemically identical yet economically stratified, are subject to tiered discrimination by private insurers reveals the deep epistemological fracture between medical science and market ideology. One must ask: Is health a right, or merely a purchasable commodity?

Anna Roh

My plan dropped my generic from Tier 1 to Tier 2 last year. I switched. Saved $400. Done.

Tiffany Sowby

Why are we even talking about this like it’s a win? We’re in the United States. The richest country on earth. And we’re proud that people don’t have to pay more than $2,000 a year for life-saving drugs? That’s not progress. That’s a national shame. You think this is fair? You think this is what freedom looks like? Wake up. This system is broken - and you’re just learning how to survive inside it.