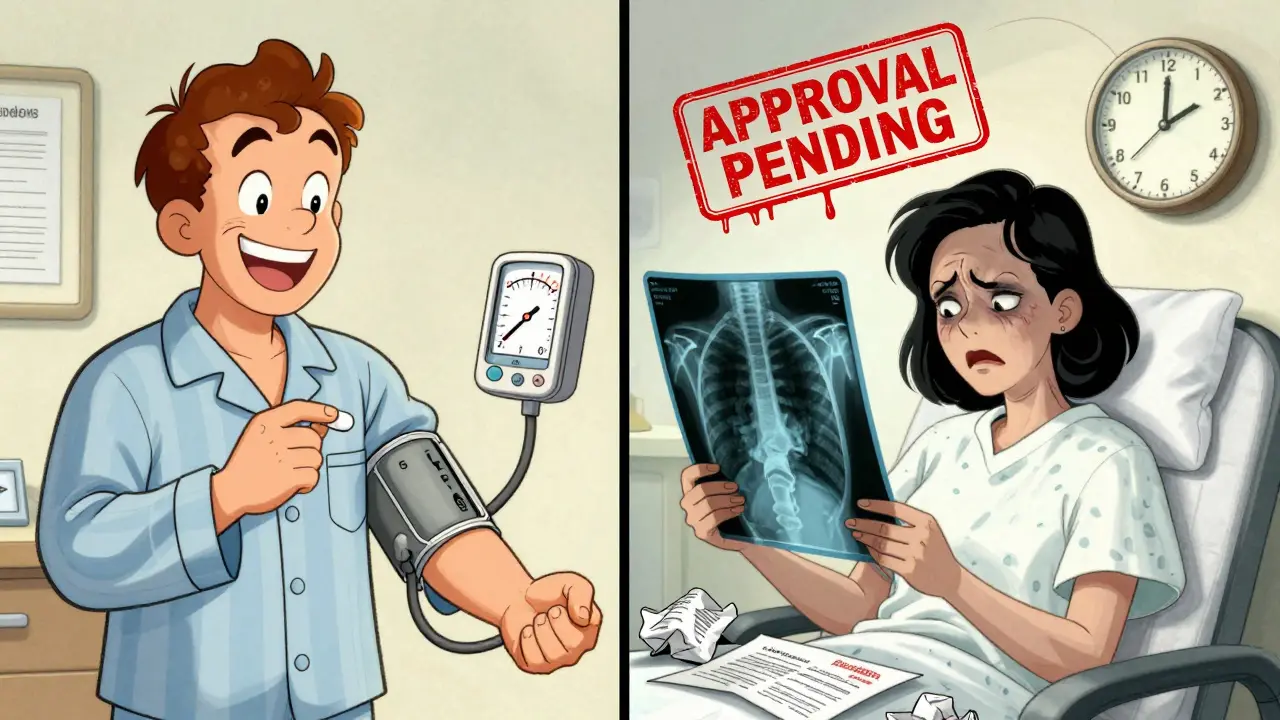

When your doctor prescribes a brand-name medication for your condition, but your insurance won’t cover it unless you try cheaper options first, you’re dealing with step therapy. It’s not a glitch in the system-it’s a deliberate policy. And it affects millions of people every year.

Step therapy, also called a "fail-first" rule, means your insurer requires you to try one or more lower-cost drugs-usually generics-before they’ll pay for the medication your doctor actually recommended. This isn’t about saving a few dollars on a prescription. It’s about controlling billions in drug spending across the U.S. healthcare system. But for patients, it can mean months of pain, worsening symptoms, or even permanent damage while waiting for approval.

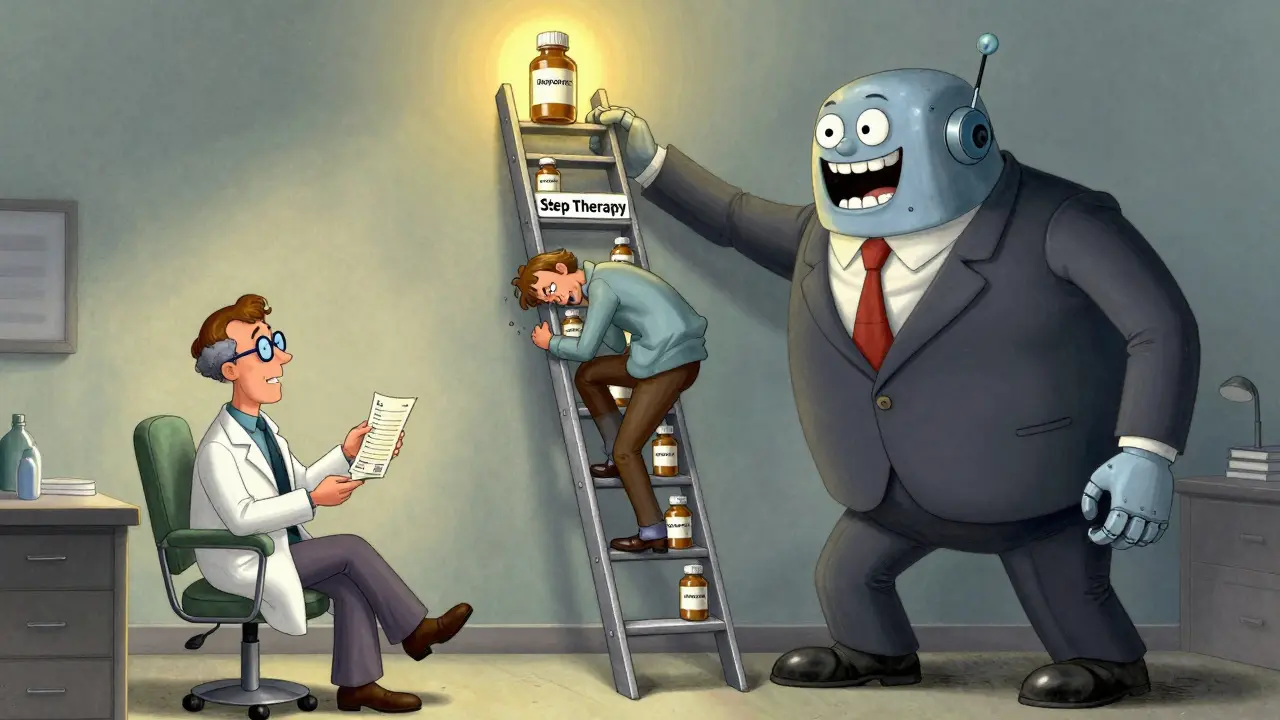

How Step Therapy Actually Works

Imagine your rheumatoid arthritis doctor prescribes a biologic drug that costs $5,000 a month. Your insurance plan doesn’t cover it right away. Instead, they require you to try three different generic NSAIDs first-ibuprofen, naproxen, and celecoxib. Each one fails. You still have swelling, joint pain, and stiffness. But your insurer won’t move forward until you’ve documented that each lower-tier drug didn’t work.

This is step therapy in action. Medications are grouped into tiers. Step one is usually the cheapest: generics. Step two might be a slightly more expensive brand-name drug. Step three is the specialty drug your doctor wants. You have to climb each rung before you get to the top.

According to a 2022 NIH review, about 40% of all prescription drug coverage plans in the U.S. use step therapy. That number is rising. By 2025, it’s expected to cover 55% of specialty drug prescriptions. These rules are most common for conditions like arthritis, multiple sclerosis, depression, and asthma-diseases where effective treatments exist but come with high price tags.

Why Insurers Use Step Therapy

Insurance companies aren’t being cruel for no reason. They’re responding to skyrocketing drug prices. In 2022, the average cost of a specialty drug was over $10,000 per year. Generic versions of the same drugs often cost less than $100. That’s a 99% difference.

Insurers argue step therapy ensures patients get the most cost-effective treatment first. A 2021 Congressional Budget Office analysis found step therapy can reduce pharmaceutical spending by 5% to 15% in certain drug classes. That’s billions saved across the system.

But here’s the catch: those savings come at a cost. When a patient with Crohn’s disease is forced to try three ineffective oral medications over six months before getting access to a biologic, their intestines keep getting damaged. When someone with severe depression has to try four antidepressants before getting the one that actually works, they may lose their job, relationships, or worse.

Insurers say they’re just being responsible. Doctors and patients say they’re being reckless.

The Human Cost of Delayed Care

Real people are getting hurt.

On Reddit, a user named "ChronicPainWarrior" shared how they spent six months trying three different NSAIDs before their insurer approved a biologic for rheumatoid arthritis. By then, their joints were permanently damaged. They needed surgery.

The Arthritis Foundation surveyed over 1,000 patients in 2022. Sixty-eight percent said step therapy caused negative health outcomes. Forty-two percent reported their condition worsened during the required drug trials.

It’s not just about pain. It’s about time. The average time to get a step therapy exception approved is four to eight weeks. Some insurers take up to three months. During that time, patients can’t get the medication their doctor says they need. They can’t work. They can’t care for their kids. They can’t live normally.

And when people switch jobs or insurance plans? They have to start the whole process over-even if they’ve been on the same medication for five years. One patient told a reporter they had to re-try three failed drugs after switching from Medicaid to a new employer’s plan. They were already stable. But the system didn’t care.

When Step Therapy Actually Helps

It’s not all bad. Sometimes, the cheaper drug works just fine.

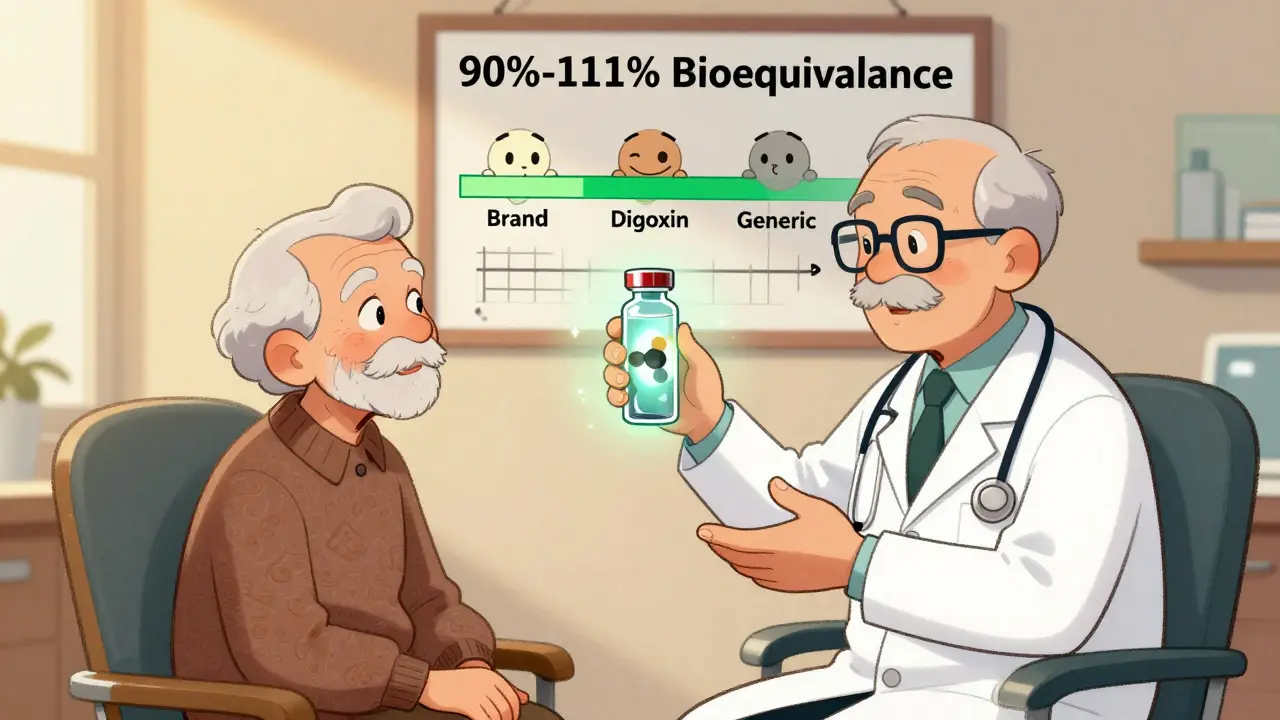

A 2023 GoodRx survey found that 17% of patients who went through step therapy ended up doing better on the generic version than they ever did on the brand-name drug. One man with high blood pressure was switched from a $200-a-month brand to a $5 generic. His blood pressure improved. His side effects disappeared.

That’s the ideal outcome: the right drug, at the right price, without unnecessary cost. But that’s not the norm. The system is designed to assume the cheaper option is always better. It’s not.

What You Can Do: Step Therapy Exceptions

You don’t have to accept this. There’s a legal way out: the step therapy exception.

Under federal and state laws, insurers must allow exceptions if:

- The required drug has already failed for you

- The required drug would cause serious harm

- The required drug is contraindicated due to another condition you have

- Delaying treatment would cause irreversible damage

- You’re already stable on your current medication and it was previously covered

Your doctor has to submit paperwork proving one of these applies. That means medical records, lab results, previous treatment logs, even letters explaining why the generic won’t work for you.

Blue Cross Blue Shield of Michigan says they review standard exceptions in 72 business hours. Urgent cases? 24 hours. But in practice, many insurers drag their feet. Some take weeks. And if your doctor’s office is understaffed-or doesn’t know the rules-they might not even file the request.

According to the American College of Rheumatology, physicians spend an average of 18.3 hours per week just handling prior authorizations and step therapy requests. That’s almost half a workday. No wonder many doctors give up.

State Laws vs. Federal Gaps

As of 2026, 29 states have passed laws to protect patients from abusive step therapy practices. These laws require insurers to:

- Provide a clear exception process

- Set time limits for approval (usually 72 hours)

- Recognize prior treatment history

- Allow exceptions based on physician judgment

But here’s the problem: these laws only apply to fully-insured plans. That’s about 39% of Americans.

The other 61%-those with self-insured employer plans-are governed by federal law (ERISA). And until recently, ERISA didn’t require any step therapy exceptions at all.

The Safe Step Act, introduced in Congress multiple times since 2017, would fix that. It would force all plans-self-insured or not-to follow the same exception rules. But it’s still stuck in committee.

What to Do Right Now

If your insurance is denying your prescribed medication:

- Ask your doctor to file a step therapy exception immediately. Don’t wait.

- Get a copy of your insurance plan’s formulary. It’s online. Look up your drug and see what step it’s on.

- Request the step therapy protocol in writing. Insurers are legally required to provide it.

- Document everything: dates, names, what was said, what was sent.

- If denied, appeal. Most plans have a two-step appeals process. If that fails, contact your state insurance commissioner.

Many patient advocacy groups-like the Arthritis Foundation and Step Therapy Awareness-offer free templates for exception letters. Use them.

The Future of Step Therapy

Step therapy isn’t going away. Drug prices are still too high. Insurers need tools to manage costs.

But the system is broken. Patients are being treated like data points. Doctors are being turned into paperwork clerks.

The next few years will decide whether step therapy becomes a smarter, faster, patient-centered process-or stays a bureaucratic nightmare that hurts people while saving money.

Until then, know your rights. Push back. And don’t let a formulary decide what’s best for your health.

Haley Graves

Step therapy isn't just bureaucracy-it's a delay tactic disguised as cost control. I watched my mother spend eight months trying five different generics for her MS before they approved her actual med. By then, her mobility was gone. No one wins when the system values spreadsheets over lives.

Diane Hendriks

The notion that step therapy is a rational cost-saving measure is a myth peddled by corporate lobbyists who’ve never held a syringe in their hand. The U.S. spends more on healthcare than any developed nation-yet we’re the only one that forces patients to suffer as a prerequisite for treatment. This isn’t capitalism. It’s cruelty with a balance sheet.

ellen adamina

I had to go through this for my depression. Four SSRIs. All made me feel worse. Took six weeks just to get the paperwork in. By then I’d lost my job. No one talks about the invisible toll.

Gloria Montero Puertas

Oh, please. You're all acting like this is some new horror show. People have been getting denied care since the 1980s-this is just the latest iteration of insurance greed. And you think a 'step therapy exception' is going to fix it? Please. The system is designed to break you before it bends. Your doctor's 'recommendation' means nothing when the algorithm says 'no.' And don't get me started on how they treat chronic pain patients-like we're all addicts waiting to be caught.

Frank Geurts

While I acknowledge the systemic challenges posed by step therapy protocols, I must emphasize that the structural inefficiencies inherent in the U.S. healthcare financing model are not unique to this domain. The confluence of pharmaceutical pricing mechanisms, third-party payer incentives, and regulatory fragmentation creates a labyrinthine environment wherein patient advocacy becomes a full-time occupation. It is not merely a policy failure-it is a failure of moral imagination at the institutional level.

Mike Berrange

So what? Insurance companies aren’t your mom. If you can’t afford the drug, you shouldn’t be taking it. People have been managing without fancy biologics for centuries. Stop whining and get a second job.

Dan Mack

Step therapy is just the tip of the iceberg. The real agenda? Big Pharma and insurers are in cahoots. They want you stuck on generics so they can keep selling you the expensive stuff later. They profit from your suffering. That’s why they delay. That’s why they make you jump through hoops. They’re not saving money-they’re creating a market. And you’re the product.

Amy Vickberg

I’ve been fighting this for years. I’ve filed 14 exceptions. I’ve emailed insurers, called reps, sent certified letters. I’ve cried in doctor’s offices. But I’m still here. And I’m still fighting. If you’re going through this right now-keep going. You’re not alone. And your voice matters. Even if they ignore you today, tomorrow someone might listen because you spoke up.

Nishant Garg

In India, we don’t have step therapy-because most people can’t afford brand-name drugs anyway. But we also don’t have insurance bureaucracies that treat pain like a spreadsheet. Here, you pay out of pocket or you don’t get it. No forms. No delays. Just reality. Maybe the real problem isn’t step therapy-it’s that we’ve turned healthcare into a transaction instead of a right. And no algorithm should decide if you live or not.