The global generic drug market isn’t just about cheap pills. It’s the backbone of affordable healthcare for billions. By 2028, it’s expected to hit over $650 billion, even as branded drugs get more expensive and complex. But this isn’t a simple story of price cuts and volume sales. The future of generics is being rewritten by technology, regulation, geopolitics, and shifting disease patterns. If you’re wondering how cheap medicines will keep working in a world of rising costs and complex therapies, here’s what’s really happening.

Why Generics Still Matter More Than Ever

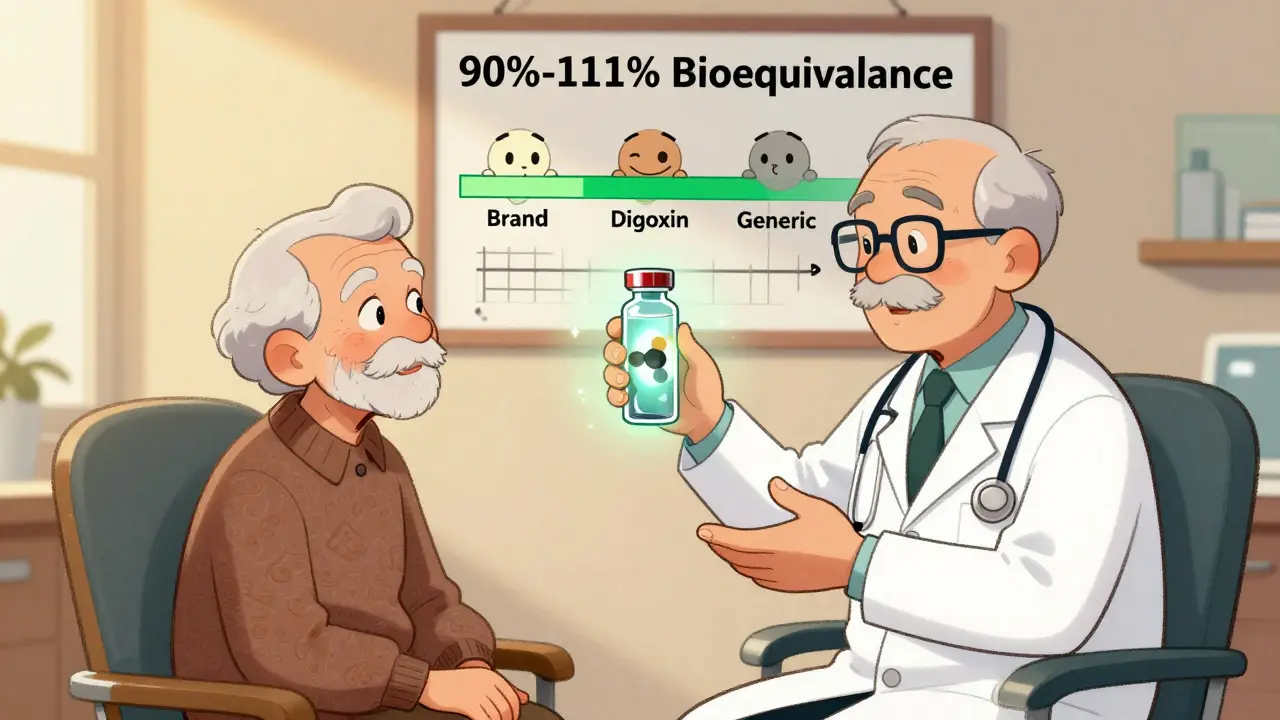

Generic drugs are not copies. They’re legally approved equivalents that contain the same active ingredients as brand-name drugs, but cost 80-85% less. In the U.S., generics make up 90% of all prescriptions but only 23% of total drug spending. That’s how they save healthcare systems billions. In Europe, countries like Germany use generics in over 70% of cases. In contrast, Italy uses them in less than 30%. Why? Because reimbursement policies and pricing rules vary wildly. The real win isn’t just savings-it’s access. Without generics, millions in low- and middle-income countries couldn’t afford insulin, blood pressure meds, or cancer treatments.

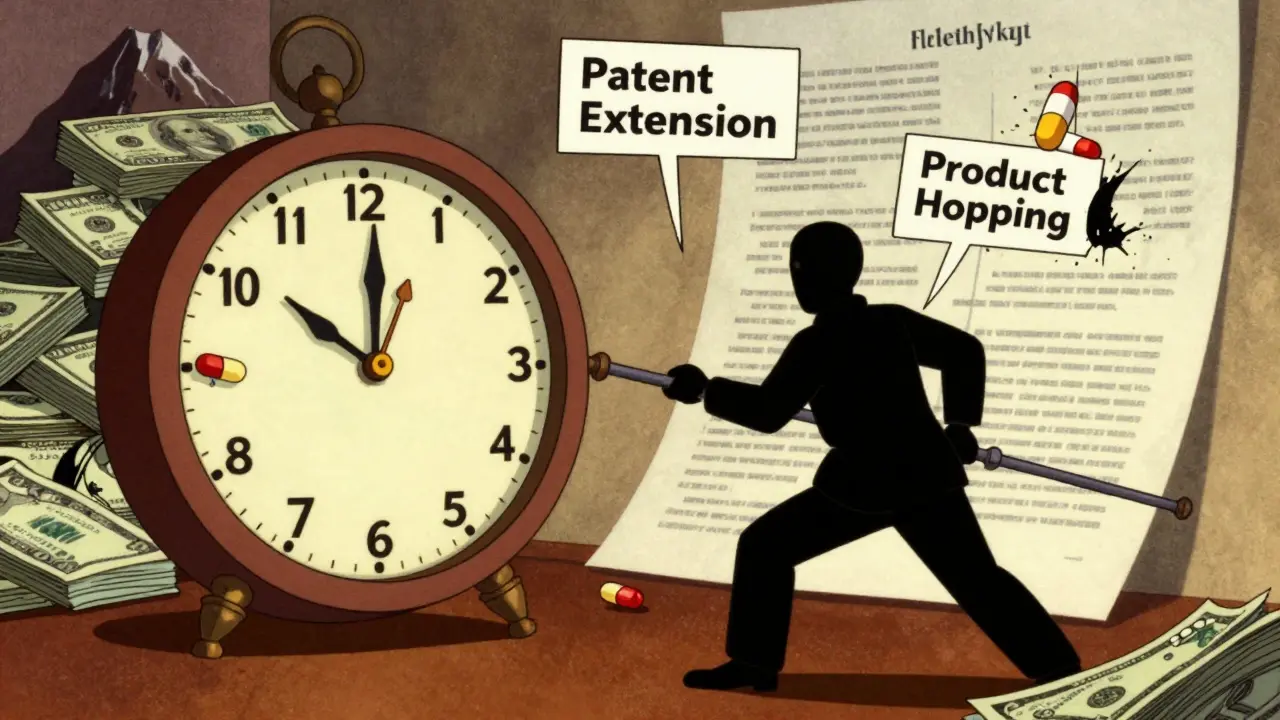

With global healthcare spending hitting $9.8 trillion in 2024 and chronic diseases affecting 41% of the world’s population, the pressure to cut costs is only growing. The patent cliff of 2024 alone saw $70 billion in branded drug revenue expire. That’s a flood of new opportunities for generics. But it’s not automatic. Who gets to make these drugs, and where, is changing fast.

The Rise of Biosimilars: Generics 2.0

Most generics today are small-molecule drugs-simple chemical compounds like metformin or lisinopril. But the next wave is biologics: complex, large-molecule drugs made from living cells. Think Humira, Enbrel, or insulin analogs. Once their patents expire, the generic version isn’t called a generic-it’s a biosimilar.

Biosimilars aren’t exact copies. Because they’re made from living organisms, even tiny changes in manufacturing can affect how they work. That’s why developing one costs $100-250 million, compared to $1-5 million for a traditional generic. The process takes 10-20 times more steps. But they’re still priced 15-30% below the original biologic, not 80% like small-molecule generics. That’s a premium, but still a massive saving for patients and insurers.

By 2030, biosimilars are expected to grow at a 12.3% annual rate. Companies like Sandoz, Amgen, and Biocon are racing to bring biosimilars for blockbuster drugs like Humira and Rituxan to market. This isn’t just a niche trend-it’s becoming the main growth engine for the entire generics industry. Smaller manufacturers without advanced biotech labs can’t compete here. That’s forcing consolidation and specialization.

Who’s Making the Pills? Asia Dominates-But Not Everywhere

India and China are the engines of global generic production. India makes over 60,000 generic medicines and supplies 20% of the world’s volume by quantity. China produces 40% of the world’s active pharmaceutical ingredients (APIs)-the raw chemicals that go into pills. Together, they control about 35% of global manufacturing capacity.

But this isn’t just about volume. It’s about control. China supplies 65% of the APIs for generic drugs globally. That’s a huge vulnerability. A single factory shutdown, trade restriction, or quality issue in China can ripple across the U.S., Europe, and Africa. The FDA issued 187 warning letters to foreign generic manufacturers in 2023-40% of them targeted facilities in India and China. Quality isn’t guaranteed just because it’s cheap.

That’s why countries are pushing back. India’s PLI scheme invested $1.34 billion in 2024 to boost domestic API production. Egypt now requires 50% of essential medicines to be made locally by 2025. Saudi Arabia and the UAE are building their own regulatory and manufacturing frameworks under Vision 2030. The goal? Reduce dependence on Asia and build local resilience.

Where Growth Is Happening: Pharmerging Markets

North America and Western Europe aren’t growing fast. Price controls, strict regulations, and fierce competition have squeezed margins. Generic profits fell from 18% in 2020 to 12% in 2024. But in the so-called pharmerging markets-places like Brazil, Turkey, Russia, India, and parts of Africa-growth is exploding.

These markets are growing at 9.66% annually. Why? Rising incomes, expanding health insurance, and government policies pushing generics. In Brazil, public hospitals must use generics unless there’s a medical reason not to. In India, the National Pharmaceutical Pricing Authority caps prices on over 1,000 essential drugs. In Saudi Arabia, the government is investing billions to build local pharmaceutical capacity.

IQVIA estimates these markets will add $140 billion in drug spending by 2025. That’s more than the entire pharmaceutical market of Canada or Australia. For generic manufacturers, this isn’t just a growth opportunity-it’s the future. The old model of exporting cheap pills to rich countries is fading. The new model is building factories, labs, and distribution networks in emerging economies.

The Hidden Challenge: Regulation and Quality

There are 78 different regulatory systems for drugs worldwide. The FDA, EMA, and WHO have standards, but enforcement varies. A drug approved in India might not meet U.S. or EU standards. The FDA’s warning letters in 2023 weren’t random-they targeted specific issues: poor sanitation, falsified data, inconsistent testing, and unapproved process changes.

Dr. Elena Rodriguez of the FDA warned in 2024 that quality control in the global supply chain remains a “significant concern.” The problem isn’t just bad actors-it’s scale. When a factory in Hyderabad makes 10 billion pills a year for 50 countries, even a 0.1% defect rate means millions of faulty doses. That’s why harmonization efforts through the ICH (International Council for Harmonisation) are accelerating. In 2024 alone, 15 more countries adopted ICH guidelines, making approvals faster and more reliable.

But harmonization doesn’t mean uniformity. Countries still have different priorities. The U.S. focuses on safety. India focuses on volume. Brazil focuses on affordability. The winners will be companies that can navigate all three.

What’s Next? Consolidation, Innovation, and Localization

The era of the small generic manufacturer is ending. Profit margins are too thin. Competition is too fierce. The future belongs to companies that can do three things: become bigger, eliminate middlemen, and offer more than just pills.

Big players like Teva, Mylan, and Sun Pharma are buying up smaller firms. They’re also moving into value-added services-like patient adherence programs, digital health tools, and bundled pricing with diagnostics. One company in Germany now offers a diabetes management package: generic metformin, a glucose monitor, and a mobile app-all for one monthly fee.

At the same time, local production is rising. Countries that used to import 90% of their generics are now building factories. Egypt, Nigeria, and Indonesia have announced new API plants. Even Mexico is investing in biosimilar production. The goal isn’t just to save money-it’s to control supply chains.

And while generics will still make up most prescriptions, their share of total drug spending is expected to drop from 57.6% in 2024 to around 53% by 2030. Why? Because specialty drugs-like GLP-1 weight loss drugs and gene therapies-are growing faster. But that doesn’t mean generics are disappearing. It means they’re becoming more strategic. They’re not just the cheap option anymore. They’re the essential one.

Final Outlook: Affordable, But Not Easy

The future of global generic markets isn’t about more pills. It’s about smarter, safer, and more resilient systems. Biosimilars will drive growth. Asia will still dominate production-but not forever. Emerging markets will become both consumers and producers. Regulation will tighten. Supply chains will localize. And the companies that survive won’t be the ones with the lowest prices. They’ll be the ones with the best quality, the strongest partnerships, and the clearest understanding of local needs.

If you’re a patient, this means better access to affordable medicines. If you’re a policymaker, it means investing in local manufacturing and quality control. If you’re in the industry, it means adapting-or getting left behind. The global generic market isn’t slowing down. It’s evolving. And the next decade will decide who gets to lead it.

Konika Choudhury

India makes 60k generics and feeds the world yet we get called unsafe

USA imports 80% of its APIs from us then acts like we’re cheating

Wake up the world needs our pills not your moral panic

Our factories don’t lie your FDA inspections do

Darryl Perry

The data in this post is accurate but the tone is naive.

Generics are not a humanitarian project.

They are a cost-cutting mechanism for insurers and governments.

Patients benefit incidentally.

The real story is corporate consolidation and regulatory arbitrage.

Stop romanticizing cheap pills.

Windie Wilson

So let me get this straight

China makes the chemical

India makes the pill

USA pays for it

And we’re all supposed to clap because it’s ‘affordable’?

Meanwhile my insulin costs $300 because ‘patents’

Meanwhile my tax dollars fund the R&D

Meanwhile my neighbor in Lagos gets it for $2

What a world

Daniel Pate

There’s a deeper philosophical question here.

If a drug is chemically identical but made in a different factory under different labor conditions, is it the same medicine?

Or is the context-the history of extraction, the geopolitical imbalance, the labor exploitation-part of its identity?

We treat pills as pure chemistry but they’re embedded in power structures.

When we say ‘affordable’ we’re really saying ‘acceptable suffering’.

And that’s not a medical problem.

It’s a moral one.

Amanda Eichstaedt

I’ve been on generic metformin for 8 years.

It works.

My grandma in rural Tennessee takes her generic blood pressure med every day.

She’d be dead without it.

People act like generics are some shady back-alley deal.

They’re not.

They’re the reason millions wake up every morning.

Don’t let corporate fearmongering make you forget that.

Cecelia Alta

Oh wow look at this fancy article with charts and percentages

Let me grab my monocle and my copy of the FDA warning letters from 2023

Because nothing says ‘public health triumph’ like a factory in Hyderabad with no running water making 10 billion pills a year

And we’re supposed to be proud?

And the US government spends billions subsidizing this ‘supply chain resilience’?

Meanwhile my cousin in Ohio got a fake batch of metformin that gave her liver failure

And now she’s on dialysis

And this whole post is just a glossy PR brochure for Big Generic

Stop pretending this is about access

It’s about profit with a side of colonialism

Rebekah Cobbson

Thank you for writing this with such clarity.

It’s easy to get lost in the politics and fear.

But at the core, this is about people who can’t afford to choose between medicine and rent.

Generics aren’t perfect.

But they’re the best tool we have right now.

Let’s push for better regulation, yes.

But let’s never lose sight of what they actually do.

They save lives.

That’s not a statistic.

That’s your neighbor.

That’s your parent.

That’s me.

Audu ikhlas

Nigeria building pharma plants? Lol

Our boys in Lagos still use Indian generics because they work

And they cost less than your fancy American bread

Stop pretending Africa needs to ‘build capacity’

We don’t need your tech

We need your money

And your respect

Stop talking like we’re children who need to be taught how to make pills

We’ve been making them in our heads for decades

Sonal Guha

Biosimilars are a scam

15-30% cheaper? For $100M R&D?

Big Pharma just renamed their monopoly

Same patent games

Same middlemen

Same profit margins

They just added ‘bio’ to the label

And now you’re supposed to cheer?

Wake up

It’s the same circus

Just with more lab coats