When a brand-name drug’s patent is about to expire, the race to bring out a cheaper generic version begins-not with a product launch, but with a legal notice. This is where Paragraph IV certification comes in. It’s not a marketing tactic or a regulatory shortcut. It’s a legal trigger built into U.S. drug law that lets generic manufacturers challenge patents head-on, sometimes years before the original drug’s patent expires. And when it works, it drops drug prices by up to 80% overnight.

What Is Paragraph IV, Really?

Paragraph IV isn’t a section of a contract or a form you fill out at the pharmacy. It’s a specific part of the Hatch-Waxman Act, passed in 1984, that created a legal pathway for generic drugs to enter the market without waiting for every patent to expire naturally. Under this law, any company wanting to make a generic version of a brand drug must file an Abbreviated New Drug Application (ANDA) with the FDA. In that application, they must certify how they plan to handle the brand’s patents listed in the FDA’s Orange Book. There are four types of certifications, but only one-Paragraph IV-actually challenges the patent. That’s the one that says: “This patent is invalid, unenforceable, or our drug won’t infringe it.” That statement alone is enough to trigger a lawsuit. It’s not a threat. It’s a legal act of infringement under federal law. The moment the brand company gets that notice, the clock starts ticking.The 45-Day Countdown That Changes Everything

After a generic company files a Paragraph IV certification, it must send a detailed letter to the brand-name drug maker. This letter isn’t a casual heads-up. It has to lay out the factual and legal reasons why the patent doesn’t hold up. Is the invention obvious? Was it already published before? Does the generic drug use a different chemical process? The brand company then has exactly 45 calendar days to sue for patent infringement. If they do? The FDA can’t approve the generic drug for 30 months. That’s called a regulatory stay. It’s not a delay because of paperwork. It’s a court-imposed pause. The brand company gets time to fight in court, and the generic company gets time to prepare. But here’s the twist: the 30 months don’t start when the ANDA is filed. They start when the notice is received. That means timing matters. File too early, and you risk getting hit with multiple lawsuits. File too late, and you lose your shot at being first.Why the First-to-File Matters More Than Anything

The real prize in Paragraph IV isn’t just getting approval. It’s getting the first shot at the market. The first company to file a substantially complete ANDA with a Paragraph IV certification and win the lawsuit gets 180 days of exclusive rights to sell the generic version. No other generic can enter during that time. That’s not a small window-it’s a gold rush. In 2021, the first generic filer captured 70% to 80% of the entire generic market during those 180 days. That’s billions in revenue in just six months. That’s why companies like Barr Labs spent five years fighting Eli Lilly over Prozac®-and why Mylan risked a $1.1 billion lawsuit over Gleevec®. The stakes are that high. And because of this incentive, 87% of Paragraph IV filings are aimed at being first.

How These Lawsuits Actually Work

Most Paragraph IV cases never go to trial. About 76% settle before a judge even hears the case. But settlements aren’t always fair. For years, brand companies paid generics to delay entry-known as “pay-for-delay” deals. The Supreme Court shut that down in 2013 with FTC v. Actavis, ruling those deals were anti-competitive. Now, settlements still happen, but they’re more transparent. Often, the brand company agrees to let the generic enter on a specific date, sometimes even sharing profits. When cases do go to court, the real battle isn’t about the drug’s effectiveness. It’s about the patent’s claims. Courts hold what’s called a Markman hearing to define exactly what the patent covers. If the generic drug doesn’t match the language of the patent claim, it doesn’t infringe-even if it does the same thing. That’s why claim construction is the most critical part of the whole process. One word in a patent claim can make or break a case.Success Rates and the Cost of Losing

Paragraph IV challenges succeed about 65% of the time. That’s a lot higher than post-grant reviews at the Patent Office, which only succeed 35% of the time against pharmaceutical patents. But winning isn’t cheap. The average cost of a Paragraph IV lawsuit is $7.8 million. Compare that to an Inter Partes Review at the Patent Office, which costs around $2.1 million. That’s why only well-funded generic companies can play this game. And losing? It’s catastrophic. If a generic company loses, they not only get blocked from the market-they can be hit with massive damages. Mylan’s $1.1 billion penalty for Gleevec® wasn’t just a fine. It was a warning. Generic companies spend an average of $2.3 million just on pre-filing analysis to make sure they have a solid case before they file. One mistake, one poorly worded notice, and the FDA rejects the ANDA. In 2018-2022, 63% of rejected Paragraph IV notices failed because the legal reasoning wasn’t detailed enough.

Why Some Patents Can’t Be Challenged

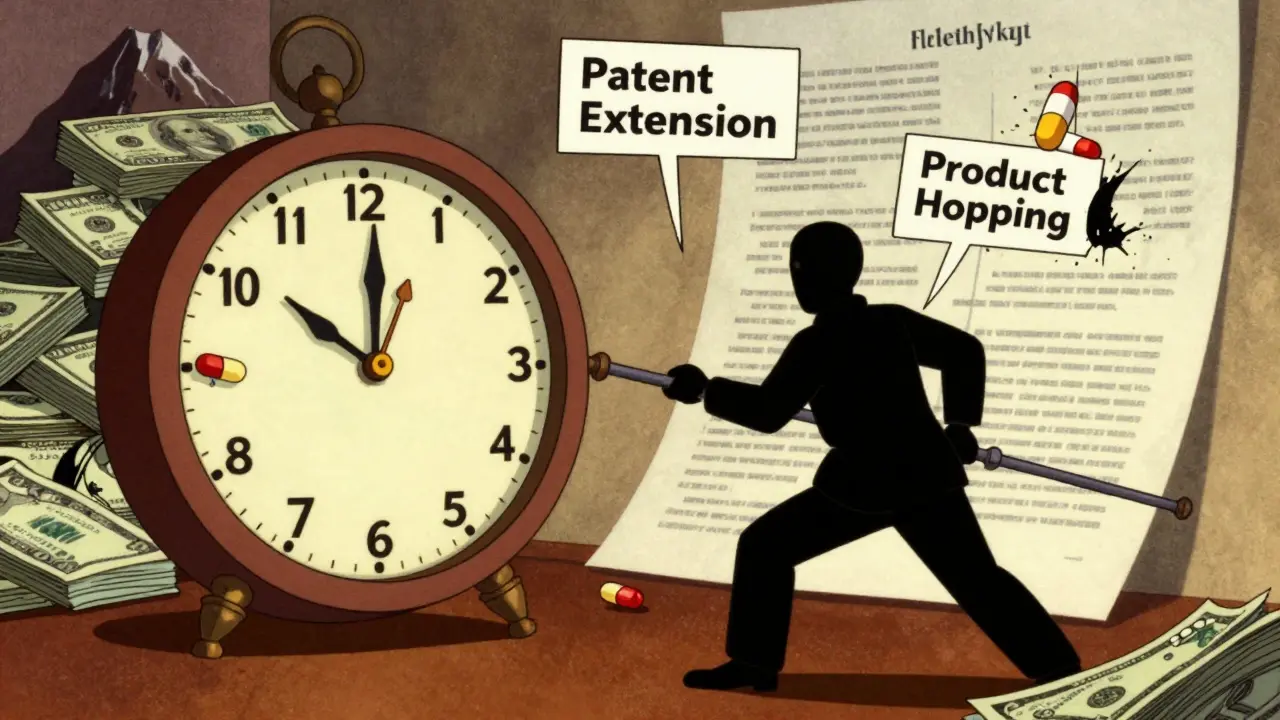

Not all patents are created equal. The strongest targets for Paragraph IV challenges are composition-of-matter patents-the ones that cover the actual chemical structure of the drug. But brand companies have gotten smarter. They now file multiple secondary patents: for how the drug is made, how it’s taken, what it’s used for, even the color of the pill. These are called “evergreening” patents. Take Humira®. AbbVie listed over 100 patents on it. Generic companies tried to challenge them in 2018. They lost. Why? Because the patents weren’t about the drug’s core chemistry-they were about delivery systems and dosing methods. The courts said those were valid. Today, 72% of new drugs have three or more Orange Book patents listed, up from 38% in the 1990s. That’s a patent thicket. And it’s slowing down generic entry.The Real Impact: Lower Prices, Faster Access

When a Paragraph IV challenge works, the effect is immediate. In 2019, after Teva successfully challenged Pfizer’s Lyrica® patent, the price of the generic version dropped 79% within six months. Between 2009 and 2019, generic drugs entering through Paragraph IV saved U.S. consumers $1.68 trillion. In 2021 alone, 287 branded drugs lost exclusivity because of Paragraph IV filings, unlocking $98.3 billion in potential generic sales. The system works because it’s designed to balance two things: rewarding innovation and making medicine affordable. But the balance is tipping. Brand companies now delay generic entry by filing citizen petitions with the FDA, requesting delays in approval. In 32% of cases, this tactic is used. The FDA’s 2022 rule now requires more transparency on these petitions. And the 2023 CREATES Act makes it harder for brand companies to refuse to sell samples needed for testing-another common delay tactic.What’s Next for Paragraph IV?

The future of Paragraph IV is messy. The Inflation Reduction Act of 2022 lets Medicare negotiate drug prices, which could change how brand companies behave during the generic entry window. Meanwhile, more companies are combining Paragraph IV litigation with Patent Trial and Appeal Board (PTAB) reviews. In 2022, 47% more cases saw coordinated filings between federal court and the Patent Office. The FTC says reforming Paragraph IV to stop patent thickets is a top priority. The Congressional Budget Office found that effective market exclusivity for brand drugs has grown from 12.1 years in 1995 to 14.7 years in 2022. That’s not because of better science. It’s because of legal strategy. For now, Paragraph IV remains the most powerful tool we have to bring down drug prices. But it’s a tool that only works if you know how to use it-and if you have the money, the lawyers, and the guts to risk it all.What is a Paragraph IV certification in the context of generic drugs?

A Paragraph IV certification is a legal statement filed by a generic drug manufacturer with its Abbreviated New Drug Application (ANDA) asserting that a patent listed for the brand-name drug in the FDA’s Orange Book is either invalid, unenforceable, or will not be infringed by the generic version. This certification triggers a patent infringement lawsuit from the brand company and can lead to early generic market entry if the generic wins.

How does Paragraph IV trigger a 30-month delay in generic approval?

When a brand-name drug company receives a Paragraph IV notice, it has 45 days to file a patent infringement lawsuit. If it does, the FDA is legally required to delay approval of the generic drug for up to 30 months, regardless of whether the lawsuit is resolved. This is called a regulatory stay and is designed to give the patent holder time to defend its intellectual property in court.

Why do generic companies risk lawsuits to file a Paragraph IV certification?

The first generic company to successfully challenge a patent through Paragraph IV gets 180 days of market exclusivity, during which no other generic can enter. This exclusivity period often generates billions in revenue, making the high cost and risk of litigation worthwhile. In 2021, first-to-file generics captured 70-80% of the market during this window.

Can brand companies prevent generic entry by filing many patents?

Yes. Brand companies often list multiple secondary patents in the Orange Book-covering formulations, methods of use, or manufacturing processes-to create what’s called a patent thicket. These patents are harder to challenge than the original composition-of-matter patent. In 2020, the average drug had 4.8 Orange Book patents, up from 1.2 in 1984, making it harder for generics to enter without facing multiple lawsuits.

What happens if a generic company loses a Paragraph IV lawsuit?

If a generic company loses, the FDA cannot approve its drug until the patent expires. The company may also be liable for damages, including lost profits and legal fees. In extreme cases, courts have awarded over $1 billion in damages for willful infringement, as seen in Mylan’s case against Novartis over Gleevec®.

How does Paragraph IV differ from biosimilar patent litigation?

Paragraph IV applies to small-molecule generic drugs under the Hatch-Waxman Act and includes a fixed 30-month stay and 180-day exclusivity. Biosimilars, regulated under the BPCIA, follow a more complex “patent dance” process with no automatic stay and 12 months of exclusivity. There’s no equivalent to the 180-day exclusivity period for biosimilars, making the financial incentive much lower.

Do other countries have a system like Paragraph IV?

No. The European Medicines Agency and most other countries don’t have an equivalent to Paragraph IV. Generic manufacturers in Europe typically wait until all patents expire before launching, which delays market entry by years compared to the U.S. system. This is one reason why generic drugs are often cheaper and available sooner in the United States.

Mindee Coulter

This is such a wild system. I had no idea a single legal notice could drop drug prices by 80%. It’s like the law itself is rigged to favor the little guy if they’ve got the guts and the lawyers.

Bravo to the generics who fight this fight. We all win when prices drop.

Rhiannon Bosse

Oh please. Don’t act like this is about ‘affordable medicine.’ It’s a corporate war disguised as public good.

Brand companies? They’re playing 4D chess. Generics? They’re the pawns who get rich for 6 months before the next lawsuit drags them into bankruptcy.

And don’t even get me started on how the FDA is just a rubber stamp for Big Pharma’s patent thicket schemes. They’re all in bed together. You think that ‘180-day exclusivity’ isn’t a backdoor monopoly? LOL. Wake up.

Meanwhile, you’re paying $200 for insulin while some lawyer in Delaware got a bonus for ‘winning’ the patent game. This isn’t capitalism. It’s legal extortion with a side of irony.

Bryan Fracchia

It’s kind of beautiful, really. A system designed to balance innovation and access - and it mostly works, even if it’s messy.

Yeah, the lawsuits cost millions, yeah, the patent thickets are ridiculous, yeah, the stakes are insane.

But at the end of the day, this is one of the few places where the law actually lets a startup with a good argument take down a billion-dollar corporation - and win.

It’s not perfect. But it’s the closest thing we’ve got to justice in pharma.

Let’s not throw the baby out with the bathwater. Fix the loopholes, don’t kill the mechanism.

Lance Long

OH MY GOD. I JUST REALIZED SOMETHING.

THIS IS THE ULTIMATE GAME OF CHICKEN - BUT WITH LIVES ON THE LINE.

One company bets $7.8 million on a single sentence in a patent.

Another bets billions on the idea that ‘we invented this molecule, so no one else can touch it.’

And in the middle? People who can’t afford their meds.

It’s not a legal system. It’s a psychological thriller written by Shakespeare and directed by Wall Street.

And we’re all just watching the drama unfold while our prescriptions get more expensive.

Someone needs to write a Netflix series about this. Like ‘Succession’ but with more depositions and fewer yachts.

Timothy Davis

You’re all missing the real point. Paragraph IV only works because the FDA’s Orange Book is a garbage data set. Half the patents listed aren’t even relevant to the drug’s formulation - they’re just noise.

And the 30-month stay? It’s not a ‘stay’ - it’s a legal loophole that lets Big Pharma extend monopolies by filing frivolous patents right before expiration.

Also, 65% success rate? That’s not impressive. That’s just the legal system being lazy. If you’re challenging a patent, you should be required to prove invalidity with real data, not just legal semantics.

And don’t even get me started on how ‘claim construction’ is just a fancy word for ‘lawyers arguing over commas.’

Sue Latham

Ugh. I’m so tired of people acting like generics are heroes. They’re just corporate opportunists with better lawyers.

And let’s be real - if you’re filing a Paragraph IV, you’re not trying to save people money. You’re trying to get that 180-day monopoly so you can jack up the price yourself.

It’s the same game. Just different players.

And the fact that you think this is ‘fair’? Honey, you’ve been watching too many YouTube explainers.

Real innovation doesn’t come from copying a molecule and suing your way to riches. It comes from science. Not lawsuits.

Lexi Karuzis

Wait... so you're telling me the FDA doesn't even verify if these patents are REAL? They just take the brand's word for it? And then we're stuck paying $500 for a drug because some lawyer wrote a vague claim about the color of the pill? I knew it. This is all a scam. The whole system is rigged. Someone is making billions off this. Someone is hiding the truth. Someone is lying to us. I'm not safe. I'm not safe.

Brittany Fiddes

Oh, so America’s got this fancy ‘Paragraph IV’ thing, do they? How quaint.

In the UK, we just wait for patents to expire - like civilized people - and then generics roll in without a single lawsuit or courtroom drama.

Our NHS doesn’t need 180-day monopolies or billion-dollar settlements to keep prices low.

Y’all turned healthcare into a legal gladiator arena and call it ‘innovation.’

Meanwhile, we’re getting life-saving meds for £2 and not a single lawyer has had to file a motion to compel discovery.

Maybe you should stop trying to ‘win’ and start trying to heal.